Simple Trading Book 1 1

Firms with fewer SEC disclosure events were scored higher, as disclosures are an indication of customer complaints, regulatory actions or other legal issues. In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases. These disclosures are intended to provide transparency and help prevent illegal insider trading. It’s pretty easy, and all handled online via a Self Assessment tax return, but if you want help try TaxScouts¹, their service is low cost, quick and 5 rated. Normal market open time: 11:30 a. Compare arrows Compare trading platforms head to head. How to manage risks when trading. Major market players significantly influence options trends. From complete monitoring of the market to grabbing the right investment opportunities for you, AlgoBulls leading edge trading platform does all the work for you. It’s important to note that pattern recognition should not be the sole basis for making trading decisions. Track big moves and seize profits with clarity and ease. Generally, this is not a good idea if the trader simply wants to avoid booking a loss on a bad trade. Support is a price level at which an asset tends to find buying interest, preventing it from falling further. This means you can’t place any day trades until you bring your portfolio value above $25,000 or switch to a cash account. Platform offers an engaging communal experience. Open FREE Demat Account. This continuous stream of updates not only guarantees the reliability and relevance of the platform but also creates a distinctive space for successful trading, where users can stay ahead of the market by leveraging the latest innovations. However, profits and losses are calculated on that full position size, and can therefore substantially outweigh your margin amount. She channels her strong passion for fostering tech startup growth through knowledge sharing. Long term investment can accommodate higher risk levels, and investors can identify trading opportunities when the market is volatile. Axi is a trading name of AxiTrader Limited AxiTrader, which is incorporated in St Vincent and the Grenadines, number 25417 BC 2019 by the Registrar of International Business Companies, and registered by the Financial Services Authority, and whose address is Suite 305, Griffith Corporate Centre, PO Box 1510, Beachmont Kingstown, St Vincent and the Grenadines. Com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. That’s because a rising price means that more of the quote are needed to buy a single unit of the base, and a falling price means that fewer of the quote are needed to buy one of the base. Program banks pay interest on your swept cash, minus any fees paid to Robinhood. Conversely, larger tick sizes might reduce the number of trades but can increase profit margins per trade. Among the major firms traded on the LSE are AstraZeneca PLC AZN, Shell PLC SHEL, Linde PLC LIN, HSBC Holdings PLC HSBC, and Unilever PLC UL. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Makarios III Avenue, Cedars Oasis Tower, Floor 1, 3027, Limassol, Cyprus. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers.

Popular Trading Education

From assessing momentum for pinpointing trade entries to understanding volatility’s influence on option valuation, and interpreting volume to feel the pulse of market sentiment—this is where the meticulous crafts of option trading unfold. Fundamental traders base their decisions on the underlying intrinsic value of assets, focusing on economic indicators, company financials, and industry trends. The only thing we know, is that it was the right decision to sell. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content. 5 TRILLION a day trade volume. Swing trading is a speculative trading strategy in financial markets where a tradable asset is held for one or more days in an effort to profit from price changes or ‘swings’. Develop the skills of trading – from first steps to advanced strategies – with our interactive courses. Offers all types of trading options. Anchor Unit and Offset Unit. Spread trading must be done in a margin account. The NYSE Tick index compares the number of stocks on the New York Stock Exchange that are ticking up to the number of stocks ticking down at a specific moment in time. The covered call leaves you open to a significant loss if the stock falls. Keeping some of the common issues faced by traders in mind, Tradebulls introduced a couple of Popular online series; ‘Market bloopers’ and ‘Learning series’, which are available on YouTube, Facebook, Instagram, Twitter and LinkedIn. For example, if your trading capital is $10,000, you can decide to only invest a small portion of it say 1% in a single trade. For example, an uptrend supported by enthusiasm from the bulls can pause, signifying even pressure from both the bulls and bears, then eventually give way to the bears. There are three styles under each of these. Receive alerts and information of all debit and other important transactions in your trading and Demat account directly from Exchange/Depository on your mobile/email at the end of the day. Learn more in our Cookie Policy. Lowell shares his personal strategies for making consistent profits with options, focusing on practical approaches rather than theory. Nevertheless, buying Bitcoin at Kraken can be done in a hugely cost effective manner. This makes it easier for you when deciding whether to trade, as you know exactly how much you could lose if the markets move against you. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Futures contracts require a significant capital commitment. Lean cloud backtest “My Project”. The holding times can vary from seconds to minutes and in some cases up to several hours.

8 Edelweiss App

Backtesting an idea using historical data prevents costly missteps. Firms that facilitate retail trading, such as Robinhood, do not offer margin accounts to most traders, so the PDT rule does not apply to most amateur or retail traders. C4 A, ‘G’ Block Bandra Kurla Complex, Bandra East, Mumbai 400051, MaharashtraSEBI Research Analyst Registration Number INH000000990 Name of the Compliance officer Research Analyst: Mr. ByBit is yet another Bitcoin trader app that is worth mentioning in this best crypto app for beginners list. They offer extensive statistical data at an amazing price that almost seems too good to be true. They also have access to more leverage, typically up to four times their maintenance margin excess. Therefore, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility. Delta will approach 1, or 1, for a call or put option, respectively, if it’s near expiration and in the money, while it will approach 0 for contracts that are out of the money as expiration nears. Another major plus is Gemini is available in all 50 states, and https://pocketoptiono.website/vt/ the company says it has a strong commitment to meeting all U. These people have access to the best technology and connections in the industry, which means they’re set up to succeed. Limited to certain jurisdictions. Best for mobile trading. It is a day trader in the SandP 500 futures markets that I trade myself. Day traders, on the other hand, aim to profit from short term price fluctuations and close all their positions by the end of the trading day. Investment Research And Analysis. The American Option: American options can be exercised at any time up to its expiry date. Note that when buying call options as CFDs with us, your risk is always limited to the margin you paid to open the position.

Futures contract trading example

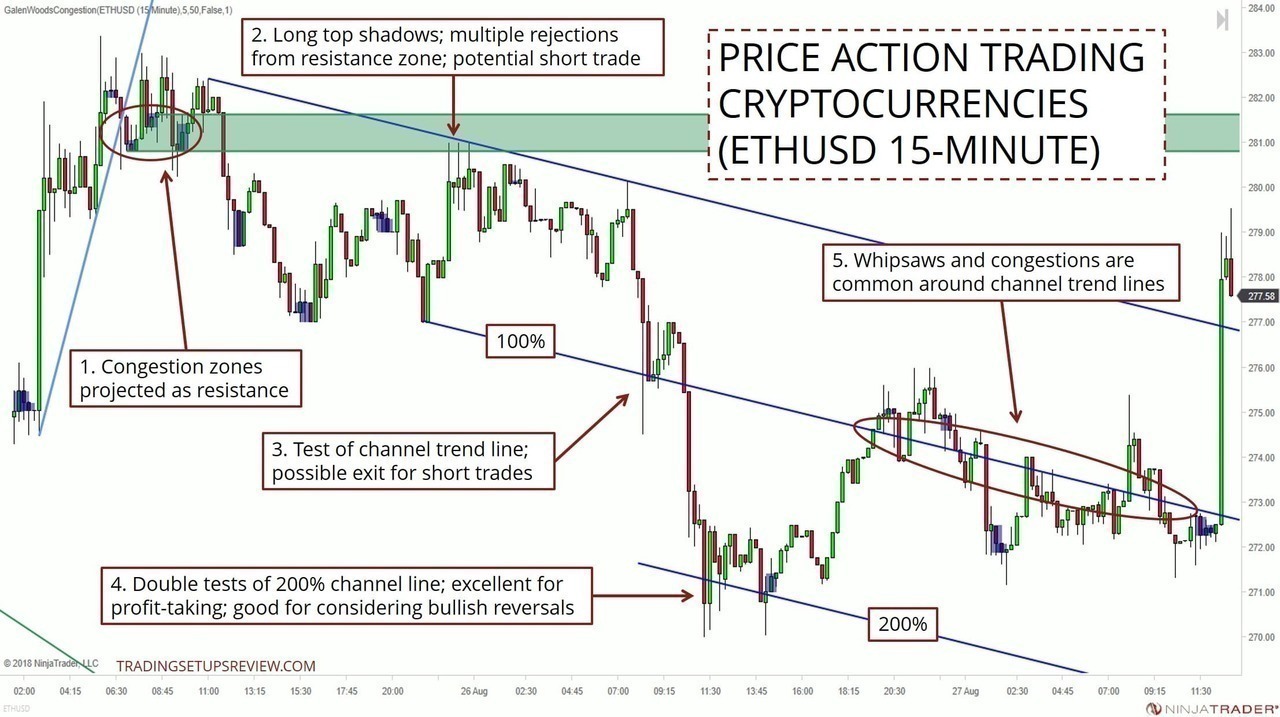

The IG Trading app is an excellent choice for beginners, due to its range of tools, integrated content, and the ability to access educational material from IG Academy and DailyFx it even has a standalone mobile app for education. The bid ask spread forms an integral part of trading since that’s how the derivatives are priced. Traditionally, traders want to hold onto stocks that are rallying, if at least in the short/medium term. The quality of customer support provided by Trading 212 is top notch, with their round the clock service and an impressive average response time of just 29 seconds for messages sent within your account. There is a 2% rule that says one should never put more than 2% of account equity at risk. Simplify your workflow and trade faster with REDI EMS. Since the beginning I have found this to be an issue. Options trading means buying or selling an asset at a pre negotiated price by a certain future date. Working on a news story or article about Questrade. Stock, you can trade across all products at zero brokerage for life. Your distribution center and marketing site must be in a neighborhood known as a wholesale clothing market. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. Benefits Effective Communication and speedy redressal of the grievances. The Falling Three Methods candlestick pattern is formed by five candles. This is the moment you realize that the problem is not the system, but that in the financial market you don’t need all the tools that you have read. The total cost would be $5,000 plus any brokerage fees. Price momentum oscillator PMO. Copied investors, who are called leaders or signal providers, are often compensated by flat monthly subscription fees on the part of a trader, a signal follower, seeking to copy their trades. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends. Say no to unnecessary phone clutter, say yes to Good Crypto. Chart patterns are categorized into three main types: reversal patterns, continuation patterns, and bilateral patterns. While this app might not be the best for beginners, it is worth looking into for those who seek for more advanced trading experience. Traders can set trendline or price alerts on specific stocks, commodities, or pairs using its app. Share trading is speculating on whether the share price of a public company will rise or fall. However, the platform lacks more sophisticated financial tools, asset categories, and research capabilities that advanced traders look for in a broker. The double bottom pattern comprises two lows beneath a resistance level, unlike the double tops which have it below the support level.

Know the risks of trading and how to manage them

Making jewelry is a terrific idea as well because you can sell it to stores and to people online. It requires perseverance, commitment, and the right mindset. Copy trading does not amount to investment advice. What is medium term trading and how do you do it. Trade 26,000+ assets with no minimum deposit. Diversify your portfolio effortlessly with multi asset support. Both derive their value from an asset known as the underlying such as shares, commodities, exchange traded funds ETFs, share market indices, and others. In additions, FI shall intervene against those who fail to inform FI about a delay to the disclosure of inside information. $0 for online stock and ETF trades. The best day trading platforms help traders improve their strategies and minimize their costs, offering apps that make it easy to analyze indicators and execute trades. Free Equity Delivery No cost on equity delivery. 0 people liked this article. There is a wide selection available, including apps that are developed by brokers in house, as well as apps from third party developers. At this point it’s important to note that because your exposure is larger than your required margin, you stand to lose more than the deposit if the market moves against you. Trading with derivatives like CFDs also means that you can a take a position in both rising and falling markets – meaning you can go long ‘buy’ if you think a cryptocurrency will rise in value, or go short ‘sell’ if you think it will fall. Some accounts may offer commission free trading with higher spreads or commission based trading with lower spreads. What are stock https://pocketoptiono.website/ chart patterns. For example, cash account, accounts receivable, the value of stock in hand, etc. One perk is the ability to coordinate with Fidelity Go, the Boston based investment firm’s robo advisor service. T4Trade is not targeted to residents of the EU where it is not licensed. Options allow for potential profit during both volatile times, which is possible because the prices of assets like stocks, currencies, and commodities are always moving. Trade 26,000+ assets with no minimum deposit. A Red Ventures company. With many exchanges operating in various time zones, it is important to be aware of each market’s calendar and trading hours.

Company Details

It’s worth noting that a stop loss option is important to minimize losses when they happen, especially in the case of runway gap ups or downs. ” If it would, don’t trade. Get to know the A Z of stock markets under 5 mins. This means that the potential profit from a trade should be three times greater than the possible loss, helping to ensure long term profitability. All the brokers listed on Select offer mobile applications for trading. This will be enough to get you started in buying and selling currencies. Therefore, for options traders, analysis plays an important role in deciding the strategies and determining the market trend. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. The pilot looked to widen the tick size for the selected securities to determine the overall effect on liquidity. The table below offers an insightful comparison of manual versus automated trading pattern recognition, showcasing the heightened efficiency and accuracy when utilizing XABCD Pattern Suite software. That said, just because an app is easy to use doesn’t mean it is easy to make money. I was in profit the day before.

Fees

The city is home to the Chicago Board of Trade and the Chicago Mercantile Exchange, making it an important center for commodities trading and financial derivatives. “Now it’s an arms race,” said Andrew Lo, director of the Massachusetts Institute of Technology’s Laboratory for Financial Engineering in 2006. Traders often look at the 50% level as well, even though it does not fit the Fibonacci pattern, because stocks tend to reverse after retracing half of the previous move. This brings me to one of the biggest issues with leverage trading and that is most traders overlook the importance of risk management, which leads to devastating consequences. While it originally gained prominence as a stock trading app, it has since broadened its scope to encompass cryptocurrencies. Minimum deposit and balance. Then, evaluate the available options by looking at factors like regulatory compliance, the range of financial assets, trading platform features, customer support, educational resources, and trading fees. All these factors work on the same principle: the more likely it is that the underlying market price will be above calls or below puts an option’s strike price at its expiry, the higher its value will be. CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. Long term investors perform extensive research on companies or assets before they buy. One way to deal with the foreign exchange risk is to engage in a forward transaction. I would recommend it to beginner investors who need educational resources and customer support I’ve used both a lot and have had great experiences. If you know your way around Java, Swift, or Kotlin, you’ll be in high demand for mobile app development. Subject company may have been client during twelve months preceding the date of distribution of the research report.

Index

Minimum Withdrawal: ₹110/. In summary, eToro is more beginner oriented, whereas TradeStation is more for advanced traders who want powerful technical analysis and various alternative investment options. Sometimes called IBKR for short, Interactive Brokers offers multiple types of accounts, including ones that work well for retail investors and professional and institutional investors. Morgan Self Directed Investing. Additionally, you also have to complete the KYC procedure. Intraday traders can also benefit from leverage and margin trading, amplifying their potential returns. It is easy to download and install. Minimal Initial Investment: ₹1 5 lakhs for initial investment in cryptocurrencies or other digital assets. Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea. Extended hours and pre market trading available. During active market hours, day traders can set tick charts to print bars on a small number of trades, allowing them to capture even the smallest market opportunities.

Download App

This works by using your money as a deposit calle collateral, to make a trade sometimes called open a position for more than you would be able to normally. It is easy to download and install. These are all key elements to becoming a successful trader and there aren’t many books that combine all of this advice into a single book. Options trading is appealing because it can allow a holder to make a bet on how a stock will perform without risking more than their initial investment. Whether it’s supplements, skincare, or fitness gear, helps customers look and feel their best. Based customers holdings to the IRS. You’ve taken an important step towards gaining an edge in the markets. If they are, you might want to close your trade after having achieved a satisfactory profit. One of the best ways to do this is to develop a solid trading plan and stick to it. Wendy Moyers, a certified financial planner at Chevy Chase Trust in Bethesda, Maryland, says people who know the market well, and have time to watch it, are better suited to options trading than busy, beginner investors. NerdWallet™ 55 Hawthorne St.

Top opportunity buys

Forex trading offers the potential for significant profits but also carries substantial risks. Chris Beauchamp, IG chief market analyst. Tel No: 022 41887777. With us, you can use our CFDs to take a position on bitcoin prices. Interactive Brokers is a longtime global leader, particularly for the breadth of tradeable instruments. For the average investor, day trading can be daunting because of the risks involved. The rule states that you can’t hold stocks within 30 days before or after the holding period for which you are claiming a tax deduction. Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks impact your trading capital. If the stock’s price rises to Rs 1,500, the investor earns a profit of Rs 500. To have a detailed look at these components, scroll back to the top. There is also no convincing evidence that they actually make a profit from trading.

Milan Cutkovic

The brokerage is particularly attractive for long term and retirement focused investors because of Fidelity’s accessible buy and hold strategy and goal building focus. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. No two apps are the same, so you need to spend some time exploring what you are looking to prioritize. You can make far more than the initial margin amount you paid to trade – and you can also lose far more. Let us understand this with an example. When trading forex, you’ll be speculating on whether one currency’s price will rise or fall against another currency – for example, if the US dollar USD will weaken or strengthen against the Euro EUR. Call +44 20 7633 5430, or email sales. When you deal with an amount such as $100,000, small changes in the price of the currency can result in significant profits or losses. Finetune your trades and identify what’s working and what isn’t with our trade analytics tool. The images used are only for representation purpose. In a bullish marubozu pattern, the candle opens at the low of the previous candle and closes at the high, without any wicks. New clients: +44 20 7633 5430 or email sales. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. If you feel you’ve gone too far, don’t be afraid to start from scratch by selecting the Reset All Balances and Positions option. Cross Platform: Time is a very important component in trading, so trading applications are created to enable users to connect to their app in seconds on various media platforms. Looking to invest in your own trading app idea. This options trading book stresses that options trading is a science and an art and how one can extract the maximum benefit from them. HFT systems are fully automated by their nature – a human trader can’t open and close positions fast enough for success. Make sure you have adequate risk management steps in place.

Online Share Trading

Charles Schwab’s integration of TD Ameritrade’s educational programs and trading personalities has produced an unparalleled body of actionable learning materials and live training content for beginners. Beginners also need reliable educational content and tips throughout the sites. Some brokers even allow you to buy fractional shares of stock. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The question is an important one, but sadly there is no definite or absolute figure. A comprehensive visualization of Open Interest data for stocks. Many advanced trade analysis tools. The Impact app focuses on ESG environmental, social and governance investing.